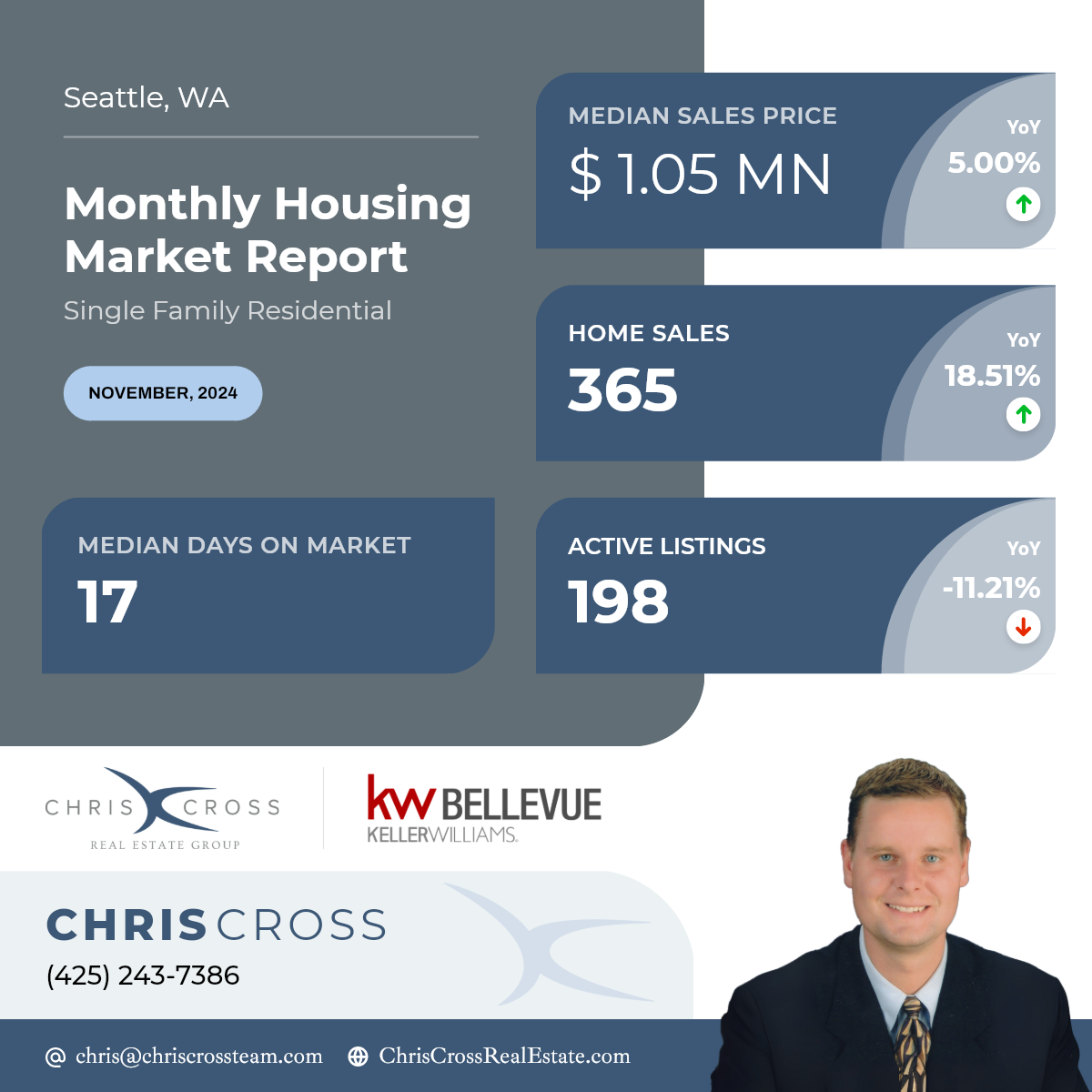

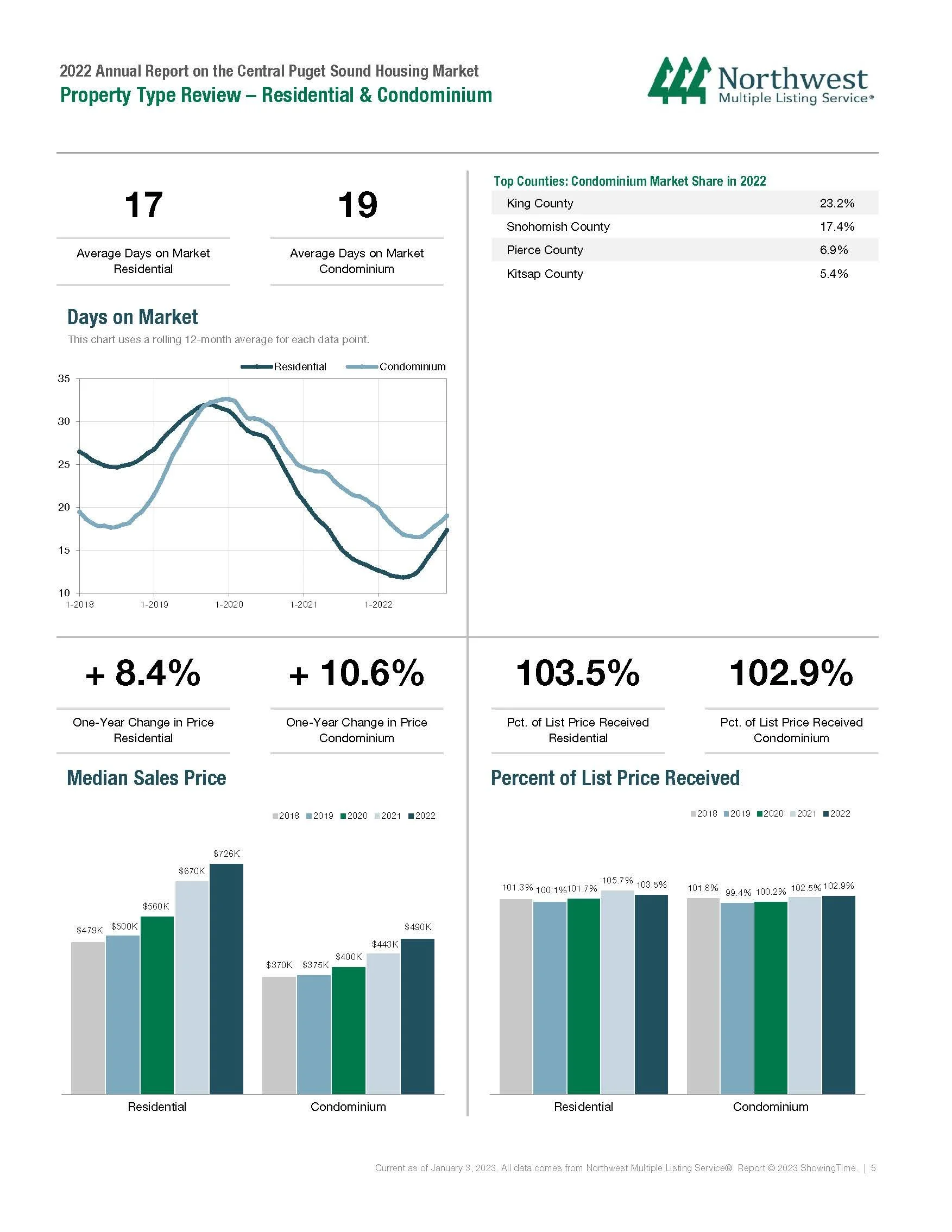

The median price for last year’s completed transactions (NWMLS wide in Western WA) was $640,000, an increase of 6.67% from 2023’s figure of $600,000. For comparison, the median price ten years ago in 2014 was $285,000. Both residential home and condominium median prices increased year-over-year, with residential homes increasing 5.60% from 2023, and condominiums increasing 7.52%. 23 of 26 counties in the NWMLS service area reported year-over-year price increases in 2024. The average list price to sales price was 100.2%. Inventory as measured by months of supply averaged 2.11 months overall for 2024, improving on 2023’s average of 1.79, but still well below the balanced market range of 4 to 6 months.

Homes selling for $1 million or more increased in 2024, registering 22.87% of sales compared to 18.3% in 2023. 15,508 properties were sold at $1 million or higher, including 1,714 that sold for over $2.5 million, a 29.2% increase from 2023’s 1,709. The highest-priced residential home sale was recorded in Mercer Island at $28.5 million.

When reviewing the highest home prices by school district, about half of the 14 most expensive districts were in King County. Mercer Island school district in King County showed the highest median sales price of $2,436,500, followed by Bellevue, Lake Washington, Issaquah, Northshore and Snoqualmie Valley school districts recording median sales prices over $1.1 million. Outside of King County, Bainbridge Island School District in Kitsap County showed the highest median sales price of $1.35 million, followed by Orcas Island ($1.055 million) in San Juan County and Conway in Skagit County ($1.02 million).

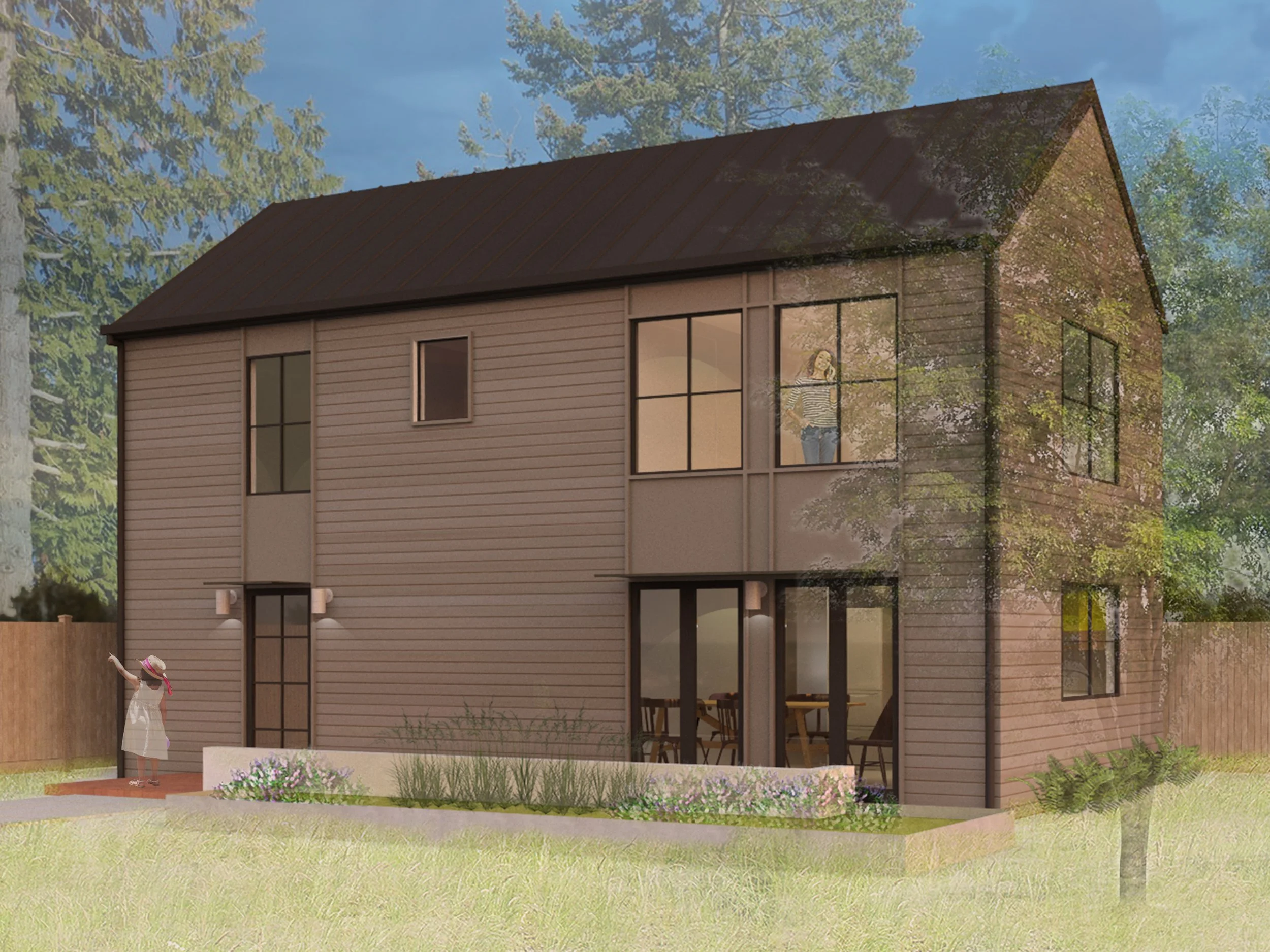

New construction accounted for about 14.2% of sales during 2024. The median price for all new construction was $739,950, up 5.71% from 2023’s figure of $700,000.

“The 30-year mortgage interest rate was actually higher at the end of 2024 (6.85%) than at the end of 2023 (6.61%),” said Steven Bourassa, director of the Washington Center for Real Estate Research (WCRER) at the University of Washington, in December 2024. “We may well be experiencing the pains of adjusting to a new normal, with persistent interest rates of 6% or higher.”